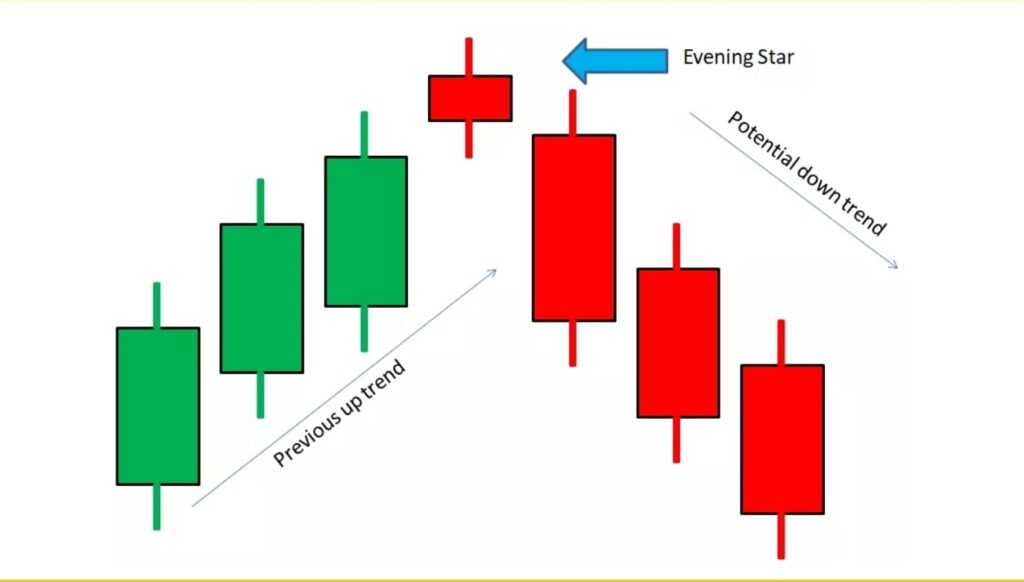

The Evening Star candlestick pattern is a bearish reversal pattern that typically occurs at the end of an uptrend. It is the counterpart to the Morning Star pattern and indicates a potential trend reversal from bullish to bearish.

The Evening Star pattern consists of three candlesticks and is characterized by the following sequence:

- The first candle is a long bullish (green) candle, indicating a continuation of the existing uptrend. This candle shows that buyers have control of the market.

- The second candle is a smaller candle with a small body, which can be either bullish or bearish. This candle represents a period of indecision and market uncertainty.

- The third candle is a long bearish (red) candle that closes below the midpoint of the first candle. This candle indicates a strong shift in market sentiment as sellers regain control.

The Evening Star pattern suggests that the buying pressure is diminishing and sellers are starting to enter the market, potentially leading to a reversal in the uptrend.

Here are some important points to keep in mind about the Evening Star pattern:

- Uptrend Requirement: The Evening Star pattern is most significant when it forms within an uptrend, indicating a potential end to the upward movement.

- Confirmation: While the Evening Star pattern is considered a strong reversal signal, it is advisable to seek confirmation through other technical indicators, such as trendlines, support/resistance levels, or momentum oscillators.

- Gap Consideration: It is not necessary for the second candle to gap up, but a gap can add to the pattern’s strength.

- Volume: Pay attention to the trading volume accompanying the Evening Star pattern. Higher volume during the third bearish candle supports the validity of the reversal signal.

- Timeframes: The Evening Star pattern can be observed on various timeframes, from intraday charts to longer-term charts. The significance and reliability may vary depending on the timeframe and market context.

- Risk Management: Traders typically place stop-loss orders above the high of the pattern to manage risk. If the pattern fails and the price moves higher, the stop-loss can help limit potential losses.

Remember, it is essential to use the Evening Star pattern in conjunction with other analysis techniques and indicators to make well-informed trading decisions.