In recent years, Artificial Intelligence (AI) and Machine Learning (ML) have ushered in significant developments in the FinTech industry. These technological advancements are reshaping the landscape of finance, offering innovative solutions and transforming the way financial services are delivered.

The Resilience of FinTech During the Pandemic

The ongoing pandemic crisis has tested the resilience of various industries, and FinTech has emerged as one of the strongholds of the financial sector. While many traditional financial companies faced challenges, numerous FinTech firms quickly adapted to provide financial services tailored to the new normal.

Even before the pandemic, some financial companies were integrating cutting-edge HiTech solutions into their business models. However, the crisis has accelerated this process, with AI and ML playing a central role in redefining how financial activities are conducted.

Unlocking Insights Through Data

As financial activities increasingly migrate to digital platforms and mobile apps, companies have gained access to vast amounts of data. This data-driven landscape presents a unique opportunity for AI and ML technologies to extract powerful insights, benefiting both users and companies.

AI and ML in FinTech: Use Cases and Impact

1. Improved Financial Decision Making

FinTech apps are equipping users with the tools to process complex financial information easily. Through data science and visualization, users can gain valuable insights, enhancing their financial decision-making capabilities.

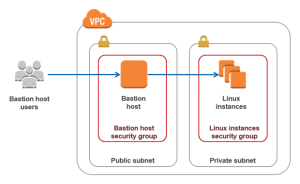

2. Security & Fraud Detection

As digital transformation sweeps across the financial sector, the threat of cybercrimes grows. AI and ML are becoming instrumental in securing accounts and detecting fraudulent activities. These technologies monitor transactions for unusual patterns, providing users with peace of mind regarding the safety of their assets.

3. Asset Management

Investment funds have long used algorithms to make forecasts and simulations. This capability has led to advancements in wealth management tools available through FinTech apps. Users can manage their finances directly from their devices, reducing intermediaries and operational costs.

4. Customer Support

Robo advisors and automated customer support powered by AI are revolutionizing customer service in FinTech. Chatbots interact with customers, providing immediate responses to a range of queries. This technology enhances customer satisfaction while reducing costs.

5. Insurance

AI and ML are reshaping how insurance policies are assessed. By analyzing user activity, FinTech apps can calculate risk levels accurately. For instance, the auto industry combines IoT and FinTech apps to evaluate driving skills through mobile apps, offering personalized insurance policies.

6. Loans

FinTech companies are leveraging AI and ML to streamline the loan approval process. These technologies assess creditworthiness based on financial habits and credit exposure, offering faster and more accurate underwriting. This approach also minimizes potential biases in lending decisions.

7. Forecasts

FinTech apps use data insights and predictive analytics to help users track their spending and achieve financial goals. By analyzing key data points, these apps provide personalized financial forecasts, enabling users to make informed decisions.

8. Personalization

The combination of AI, ML, and Natural Language Processing has enabled personalization in FinTech. Smart wallets and customized financial experiences break traditional industry stereotypes, providing users with tailored solutions.

The Impact of AI in FinTech

AI and ML are not just tools for large tech giants; FinTech companies, both large and small, are harnessing their power to innovate and provide enhanced services. These technologies hold the potential to boost growth, competitiveness, and relevance for financial companies. They can also lead to cost reductions and increased operational efficiency, ultimately benefiting users through improved personal financial management.

As we move forward, the finance industry is likely to witness the continued integration of AI and ML technologies. This computational arms race will go hand in hand with the evolution of powerful FinTech apps, opening up new possibilities for innovative financial services.

To successfully implement AI in FinTech, partnering with an app development company well-versed in the complexities of the financial world is essential. The future of finance is undoubtedly being shaped by AI and ML, promising a more efficient, secure, and personalized financial landscape.