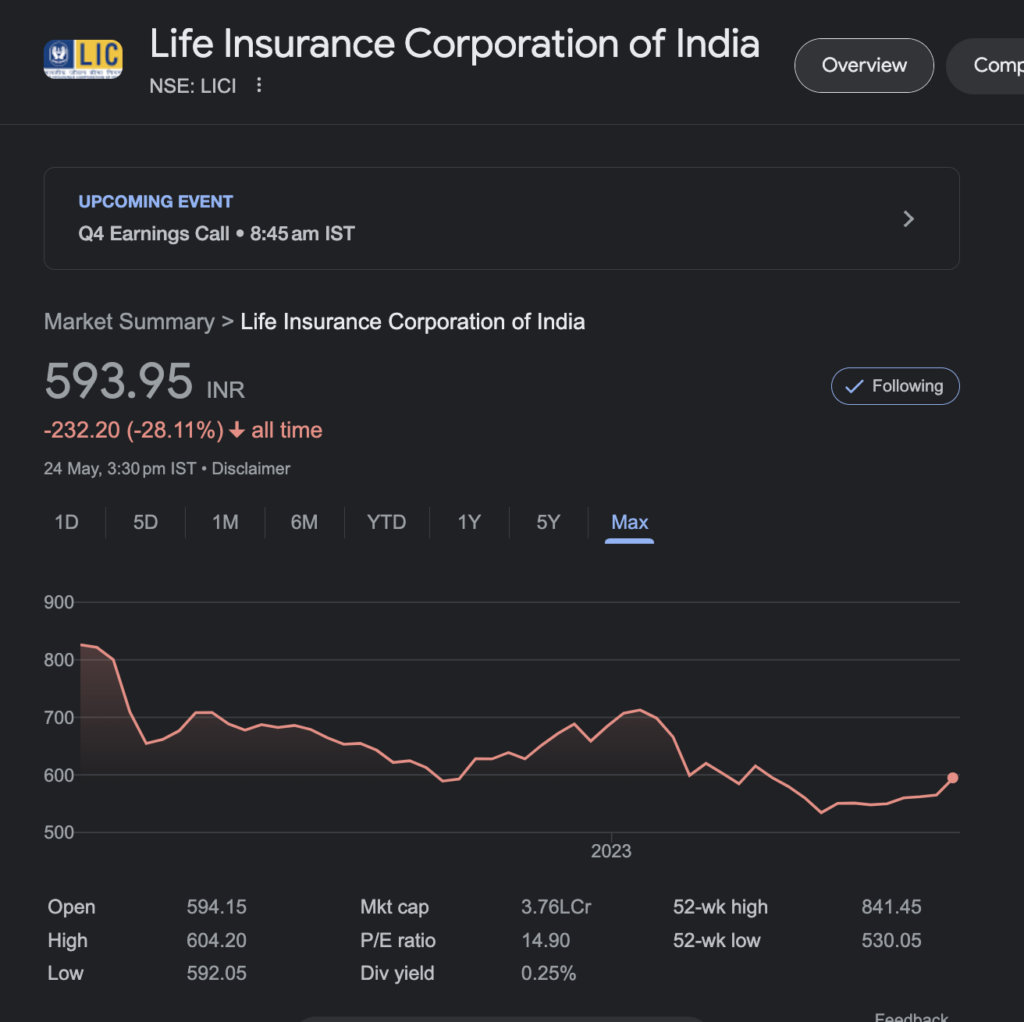

In the morning trade on Thursday, the BSE Sensex, the benchmark equity index, experienced a sharp decline of over 2,000 points following Russian President Vladimir Putin’s announcement of a military operation in eastern Ukraine. Concurrently, oil prices surged and crossed the $100 per barrel mark for the first time since 2014.

Among those most affected by the ongoing sell-off are retail investors who entered the market in the middle or late part of 2021. Their portfolios have suffered significant losses, ranging from 40% to 60%.

The absence of buyers in the current market scenario is also contributing to the downturn. Data from the corporate database Ace Equity reveals that nearly 50% of stocks in the BSE500 index have eroded investors’ wealth over the past six months. Solara Active Pharma Science emerged as the top loser in the index, experiencing a decline of 56%. Other notable decliners include Dilip Buildcon (down 46%), Mahindra Logistics (down 45%), HEG (down 44%), Vaibhav Global (down 42%), and Strides Pharma Science (down 40%).

However, there have been some notable gainers during this period, including Brightcom Group, Tata Teleservices (Maharashtra), Trident, and Adani Green Energy, which have all seen gains of over 100%.

Investors are advised to focus on companies with strong fundamentals and earnings track records to mitigate the impact of market corrections. It is important to avoid getting caught up in market euphoria and to adhere to basic rules in a bull market, as wealth erosion can continue if these principles are forgotten.

Prominent Mumbai-based investor Kedia, known for selecting quality stocks, emphasized the importance of holding onto growth stocks. He cautioned that frothy stocks, which have experienced a 50% to 60% decline, may take at least five years to recover their previous levels.

Indian investors have faced challenges and losses due to investments in loss-making companies driven by greed and unrealistic expectations. In the pursuit of quick gains, some investors have been attracted to companies with poor financial performance, speculative business models, or unsustainable growth rates. These companies often promise high returns but fail to deliver, resulting in significant losses for investors.

The situation is compounded by the fact that some investors may overlook fundamental analysis and due diligence in favor of speculative investments driven by market hype. This can lead to a disconnect between the actual value of the company and its market price, ultimately causing losses for those who bought in at inflated prices.

It is important for investors to exercise caution and conduct thorough research before investing in any company. They should consider factors such as financial health, profitability, competitive positioning, and long-term growth prospects. By focusing on companies with solid fundamentals and a proven track record, investors can reduce their exposure to the risks associated with loss-making companies.

Furthermore, it is crucial for investors to diversify their portfolios and avoid putting all their eggs in one basket. A well-diversified portfolio can help mitigate the impact of losses from individual investments and provide a more balanced risk-return profile.

Ultimately, investors need to be mindful of the risks involved in the stock market and make informed decisions based on sound investment principles rather than succumbing to the allure of quick profits or speculative trends.